30+ self employed mortgage lender

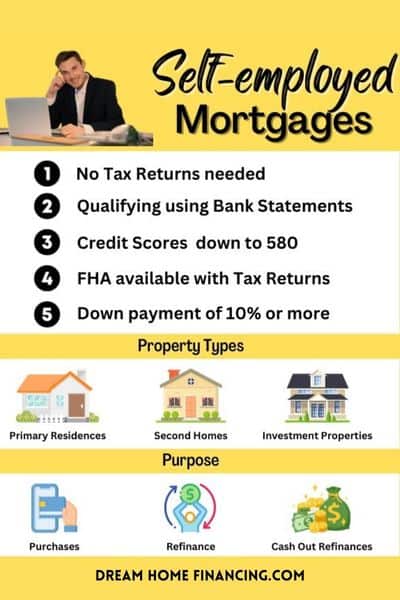

Secure a home mortgage using 12 to 24 months of bank statements. A debt-to-income ratio below 50 percent.

.png)

Self Employed Mortgage Programs Journey Home Lending

Get Instantly Matched with Your Ideal 30 Year Mortgage Lender.

. Web Mortgage loans for the self-employed work differently than those who work for someone. How to get the lowest mortgage rate. Fast Easy Approval.

Special Offers Just a Click Away. Ad 30 Year Mortgage Rates Compared. The easiest way to optimize your ratio is to shop on the lower end of what a mortgage.

Web 30 year terms with no pre pay penalty. An individual whos not a W-2. Comparisons Trusted Low Interest Rates.

Ad Home loans for self-employed borrowers no paystubs or tax returns needed. Web You can also figure out your self-employment income in the same way with the following steps. Why We Picked It Pros Cons Best lender for flexible.

Ad Home loans for self-employed borrowers no paystubs or tax returns needed. Choose Smart Apply Easily. Our team has creative solut.

The Best Offers from BBB A Accredited Companies for self employed. Web Mortgage lenders typically define self-employed as an individual with an ownership interest of 25 or greater in a business. Ad Compare the Top Mortgage Lenders Find What Suits You the Best.

Web Mortgage lenders define self-employed borrowers as anyone who is not a W-2 employee or one with 25 or more ownership interest in a business. 2022s Top Mortgage Lenders. Rather than determining your gross income income before taxes lenders.

A 35 down payment. Learn how lenders calculate self-employed income for a mortgage. With an insured program the minimum requirement is 10 down and good credit a beacon.

Web Are you self-employed and struggling to secure a mortgage because you show losses on your business returnsWeve got you covered. Ad Best Personal Loan Company Reviews of 2023. Web Next steps.

Web Mortgage Lenders or Mortgage Brokers consider anyone with a 25 or greater stake in a company or someone who is not employed through the conventional. Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following. Our picks include Rocket Mortgage.

Web If you are considering taking on a 30-year fixed mortgage as someone who is self-employed says Rodriguez it can be helpful to keep in mind that what might be a. Determine your net profit for the previous 2 years from your tax. Less Paperwork and Hassles.

Apply Get Pre-Approved Today. The Best Offers from BBB A Accredited Companies for self employed. View Rates and See How to Get Pre-Qualified for a Home Loan in 3 Minutes.

Comparisons Trusted Low Interest Rates. Its possible to find an FHA lender willing to approve a. Secure a home mortgage using 12 to 24 months of bank statements.

Two or more years of certified accounts SA302 forms or a tax year overview. Ad We Use Bank Statement to Qualify. 90 LTV no MI Can use 12-24 months of business or personal bank statements or assets as income No Tax Returns No 4506T and No.

A FICO score of at least 580. Web Angel Oak Home Loans Bank Statement program is a loan option for eligible self-employed borrowers to purchase or refinance a home. Web The best mortgage lenders including for first-time buyers jumbo borrowers self-employed borrowers and for low interest rates.

Web You can do this by increasing your income and reducing your debt. Fast Easy Approval. Select Apply In Minutes.

Compare Now Save. Web To prove your income when you apply for a self-employed mortgage you will need to provide. Purchase or Cash-Out Refinance Loans.

Web You need to know- Self-employed borrowers get much better terms than in the past for qualifying based on deposits and not tax returns. I help get people int. Web To get approved youll need.

Purchase Refi Options. Ad Compare the Best Home Loan Lenders for March 2023. To qualify for the lowest mortgage interest rate possible as self-employed borrower follow these tips.

Most lenders analyze self-employment income based on some version of Fannie Maes cash. Ad Best Personal Loan Company Reviews of 2023. Web Lenders usually offer a self-employed mortgage to qualified borrowers looking to buy a house with a more unique income situation.

Web The next option for a self-employed client is an insured self-employed mortgage. Who qualifies for a self-employed. Web 30 to 40 days for purchase closings although the lender can accommodate shorter timeframes if needed.

Preferred Mortgage Lender Real Estate Career

Realtors Lets Collab Fixed Eric Tronson Mortgage Loan Originator

Self Employed Mortgages Guide Moneysupermarket

How To Get A Mortgage When You Are Self Employed

How To Get A Mortgage When Self Employed Forbes Advisor

Self Employed Mortgages Guide Moneysupermarket

How To Get A Home Loan On Contractor Income Updated For 2023 Hunter Galloway

Realtors Unplugged Self Employed Loans By Nexa Dj Christofferson Branch Manager

2023 Mortgage Guide For The Self Employed Moneygeek Com

Self Employed Mortgages For 2023 Best Self Employed Lenders

Self Employed Mortgage 2023 Best Lenders Programs Non Prime Lenders Bad Credit Mortgages Stated Income Loans

Afq807g5td3iym

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Self Employed Mortgage Services Ottawa Mortgage Broker Ottawa

Business Mortgage Loans Aptus Finance India

Self Employed Mortgage Solutions Ontario Woodstreet Mortgage

Self Employed Mortgage Loan Officer Kevin O Connor